Taxpayer Relief Act 2026 Update – The American Taxpayer Relief Act of 2012 is a United States federal statue enacted in 2012 to address certain aspects of the so-called Fiscal Cliff, i.e. certain mandatory tax increases and budget . Because of the portability provisions made permanent in 2013 by the American Taxpayer Relief Act of 2012, the surviving spouse may tax exemption sunsets at the end of 2025. On January 1, 2026, the .

Taxpayer Relief Act 2026 Update

Source : www.taxpolicycenter.org

New property tax relief for N.J. seniors is now law. But will full

Source : www.nj.com

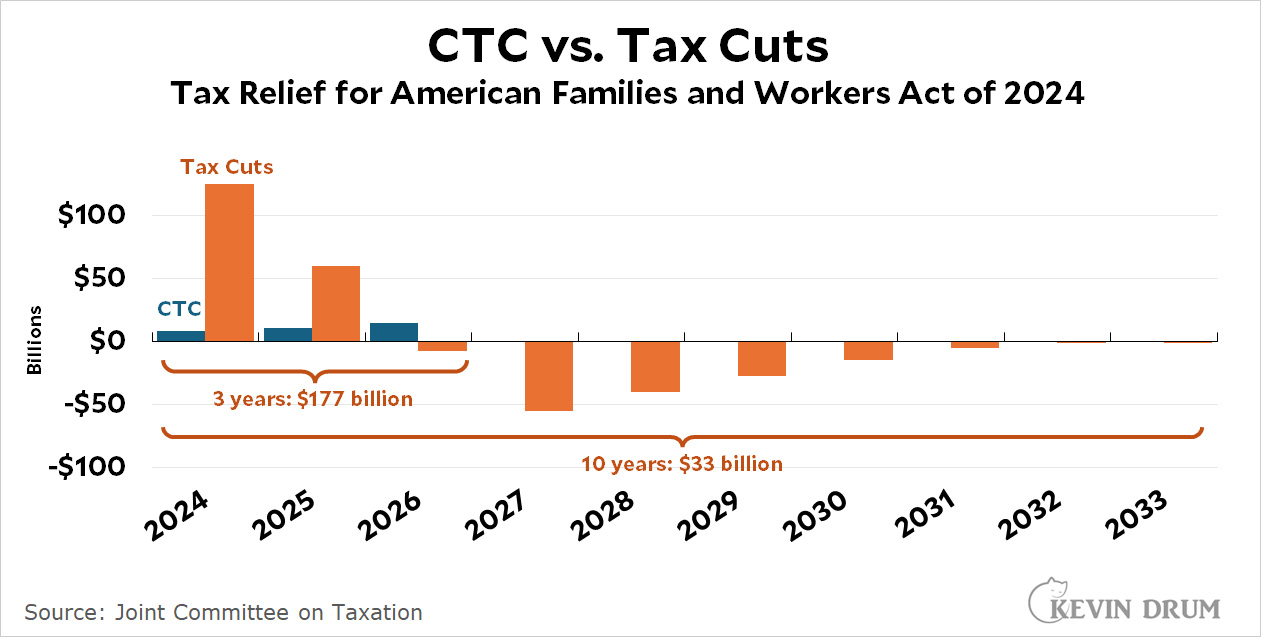

Maybe that Child Tax Credit bill isn’t so great after all – Kevin Drum

Source : jabberwocking.com

UAE New Corporate Tax Law April 2023 SBR Update Brings Relief for

Source : issuu.com

How did the Tax Cuts and Jobs Act change business taxes? | Tax

Source : www.taxpolicycenter.org

UAE New Corporate Tax Law April 2023 SBR Update Brings Relief for

Source : issuu.com

Estate Tax – Current Law, 2026, Biden Tax Proposal

Source : www.krostcpas.com

Governor Proposes ‘Forward Looking’ $9.95 Billion Budget The

Source : wyomingtruth.org

Taxation Finance Act 2021: 9781292406725: Amazon.com: Books

Source : www.amazon.com

Iowans for Tax Relief

Source : taxrelief.org

Taxpayer Relief Act 2026 Update Working Families Tax Relief Act Provides Substantial Benefits : The IRS is reopening closed Taxpayer Assistance Centers and providing Funding from the Inflation Reduction Act provided the means for the IRS to increase its in-person customer service options. . Download and save the PDF to your computer Open the downloaded PDF in Acrobat Reader 10 or later A form a taxpayer can complete and submit to request relief under the taxpayer relief provisions. .